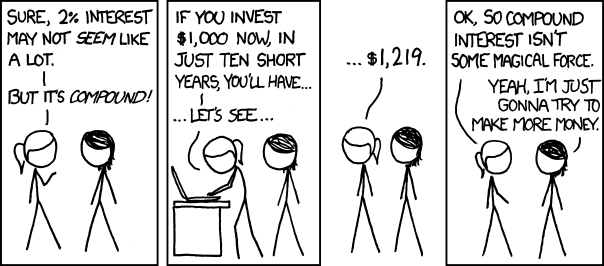

Welcome back to my little corner of the internet. Today I want to talk about compounding interest, and actually compounding in general. First to set the theme I have some insight from Randall Munroe of XKCD:

The numbers in this comic are low, but the math is sound. The idea behind it is worth looking into deeper though. Instead of relying on compound interest, the girls are going to go figure out a way to make more money. Why not do both? Make more money and have your money make you money. That is one of the keys to wealth, having your money make more money for you. Some people call that passive income and it will show up in many forms depending on what track your business is on. Where my mind is focused, we call that income from rental properties.

First lets look at the math from the comic above. 2% interest annually is quite a bit more than most people are making from their savings right now! Even their investments. So I believe the 2% to be a bit of a tongue-in-cheek moment in itself. So what is up with the numbers? Why does that seem so underwhelming? That is because the starting principal is so low. With only $1,000 to start with, 2% only gets you a couple bucks a month in interest. If you started with 1000 and ended with 1200, then you get your 2% return (1200-1000/1000 = 200/1000 = 2/10), but in this scenario we end up with an additional $20. That is the power of compounding interest, extra money was just generated without any effort. So the strength of the interest comes in that every month the principal earns a little more interest than the month before. I am going to simplify this a little, but I do have a spreadsheet where you can see these numbers for you to download. In the first 30 days, the principal will earn about $1.64. In the 5th 30 days (not exactly 5 months, this is where I am simplifying) the principal will earn $1.65. So with the $1,000 investment it will earn $1.64 each 30 days for 4 months ($6.56 in earnings) and then suddenly on the fifth month it is earning $1.65. Then three months later it is now earning $1.66! The time between each one cent a month increase shortens with every increase. With enough time the interest earned every month will increase by more than a cent.

In the spreadsheet you can see a chart that takes this example out about 85 years, and you can see that the line changes from a line into a curve. And in that 85 years the principal increases from $1000 to $5,437. Without the compounding the principal would be 2700 over 85 years. So just compounding the interest more than doubled the earnings over that time.

Like I said before, the reason that the comic is underwhelming is because the initial principal is only $1,000, and nothing more was added to it other than the interest. The biggest secret to wealth is to keep adding to your savings, as well as leveraging the compounding effect on your money. If we instead of using $1,000 as the base, what do the numbers look like if $10,000 is the base? Since the base is 10 times as much, the earnings are 10 times as much, and the ratio doesn’t change.

Let’s instead focus on the rate of return. 2% is pretty good in terms of savings accounts or CDs right now. But it is a pretty lackluster return on an investment. In real estate it is not uncommon to have 12-20% cash on cash returns. And that is just from the cashflow part of the investment. As I have noted previously there are 5 ways to make money from real estate. If just one of the 5 is already giving you a 20% return, then the others are just icing. That is the power of wealth building through real estate. So with a 12% return, and using $1,000 as the base investment, what does it look like in 10 years? Then the balance is $3,303, or just over 300% returns. Without the compounding, the balance would have been just $1,200. So compounding in this case was almost 3 times as much earnings. At 20% then the total principal after 10 years is over $7,000. That doesn’t even take into account re-investing the returns. So at 20% return, you should have your initial investment back in 5 years. If you make the exact same investment at that point then you are effectively making a 40% return for the second 5 years. Do that a few times and suddenly you are making 100% or 500% return every year. That is where true wealth is grown. Re-investing the returns and letting those compound as well as the original investments. Compound Interest is a very powerful tool for building wealth, you just can’t totally depend on it like the girls above were contemplating. Do both, make more money and utilize compound interest to grow your wealth.

Until next time,

Feel the fear, and do it anyway.

Hi this is a fantastic post. I’m going to e mail this to my associates. I came on this while exploring on google I’ll be sure to come back. thanks for sharing.